What Homebuyers and Sellers Need to Know

Mortgage rates have jumped following the Federal Reserve’s second rate cut of the year, introducing fresh complexities for buyers and sellers heading into the final stretch of 2025. The Fed’s uncertainty about another cut in December has contributed to this volatility, causing prospective buyers and homeowners to reassess their strategies in a changing market.

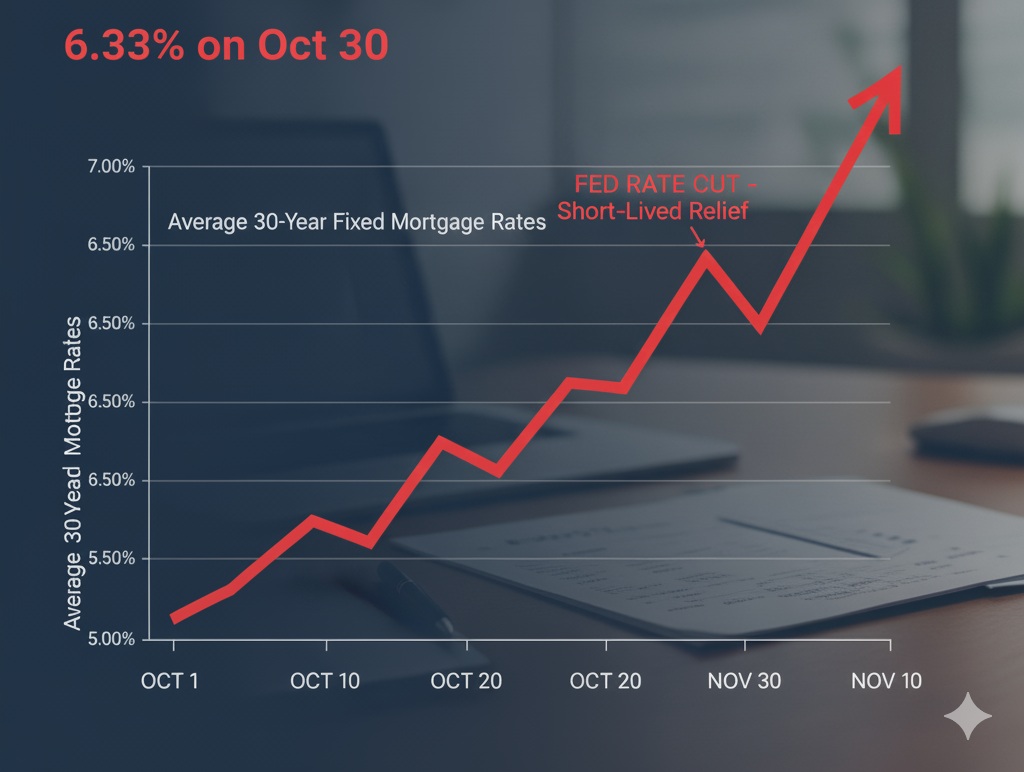

Latest Mortgage Rate Trends

Average 30-year fixed mortgage rates climbed to 6.33% on October 30, jumping from 6.27% the day before and 6.13% before the Fed’s announcement. The Federal Reserve’s 25-basis-point cut provided short-lived relief, but ongoing caution from the central bank has kept markets on edge. Freddie Mac’s weekly average shows 30-year loans at 6.17% and 15-year loans at 5.41%, key figures for buyers planning their next steps. Visit Freddie Mac for the latest mortgage rate data.

Historical Context and Seasonal Spikes

If current trends persist, 2025 will be the fourth year in a row with late-year mortgage rate spikes. Economic conditions such as inflation, labor market uncertainty, and a federal government shutdown continue to push rates higher. Understanding these patterns can help buyers and sellers plan their next moves more effectively.

What Should Buyers and Sellers Expect?

Buyers are encouraged to act swiftly to lock in favorable rates before conditions change again. Applications for USDA, FHA, and VA loans are down amid the government shutdown, but total mortgage applications rose 5% in late October, with a 7.1% increase in refinancing. This autumn may be a “sweet spot” for buyers, as increased inventory and temporarily lower rates create unique opportunities. Sellers are listing homes in record numbers to capture demand before another rate spike, especially in regions like Bergen, Essex, and Hudson County. Get more insights at Realtor.com Real Estate News.

Real Estate Indicators: Inventory, Sales, and Demand

- New listings rose 4.6% year over year for the four weeks ending October 26.

- Inventory levels increased by 6.9%, providing more choices for buyers even as some sellers withdrew homes from the market.

- Pending home sales plateaued nationally, with increases in the Northeast and South but decreases in the Midwest and West.

For local trends and actionable advice, visit housing market updates at agrealtynj.com.

Expert Insights: Looking Forward

Lower rates and higher inventory may be temporary. Buyers and sellers should watch Treasury yields, labor market changes, and regional sales data, and be ready to act fast. A real estate agent can help clients list or purchase property with timely expertise and market insight. Sellers wanting to take advantage of current conditions should consider listing promptly, using expert guidance found at agrealtynj.com/sell. For more tips on managing mortgage volatility and real estate opportunities in New Jersey, subscribe for updates and expert insights at agrealtynj.com. Your trusted partner in today’s changing market.